Protector Forsikring

Invoice automation and UI/UX Improvements

Protector Forsikring (“Forsikring” meaning insurance in Norwegian) is an insurance company headquartered in Oslo, Norway. They are known for being a specialist insurer that focuses on commercial lines of business. They offer insurance products to businesses and organizations, rather than individual consumers. They operate and have offices across Denmark, France, Norway, Sweden, and the UK.

TL;DR version

Before

Outdated and slow system and UI adding to frustration and confusion.

Creating a single invoice required 23 clicks across 14 screens, taking 3–5 minutes under ideal conditions.

Account managers spent the last 1.5–2 weeks of every month buried in invoicing, often working overtime.

Invoices were sent from individual email accounts, leading to fragmented communication and reduced credibility.

Detecting errors was time-consuming, requiring ~10 clicks and 1–2 minutes per policy, with no clear visibility into status.

Brokers frequently received delayed or inconsistent invoices, damaging trust and relationships.

After my UX/UI research and design implementation

Implemented and unified UI and frontend development for 5 international markets.

Enabled account managers to resolve issues faster by grouping errors, highlighting the specific problem, and providing quick previews to clarify whether the issue was data- or system-related.

Saved 200+ hours every month by automating repetitive manual invoicing tasks.

Projected €400,000 savings in Sweden within the first three years.

Streamlined broker communication by centralizing invoice delivery into one trusted system.

Reduced workload to zero for standard invoice processing—elimanted 23 clicks across 14 screens and cutting 3–5 minutes of manual work per invoice.

Removed 100% of manual vehicle validation by automating data sync with the Swedish Motor Agency—saving ~10 clicks and 1–2 minutes per policy.

Boosted employee morale by reducing overtime and repetitive tasks, improving retention and job satisfaction. They even threw a party to celebrate the massive reduction in workload 🎉

Strengthened broker relationships by ensuring invoices were always timely, accurate, and formatted to their preferences.

The problem

For Protector, Sweden is one of the largest markets for vehicle insurance and the most invoices per month out of any market. The existing system’s inefficient and entirely manual processes of prepping, error handling, and delivering invoices led to delays, errors, increased workload, and low morale. It was not a sustainable nor scalable process.

Business request

Design and implement an automated system to streamline invoice preparation, error handling, delivery, and management. They would like to significantly reduce manual effort, cost, and improve operational efficiency. They would like this automated system to operate in all countries.

My role

As Senior UX Designer at Protector Forsikring, I led the research and design of this initiative. My role was to talk to Swedish account managers and team managers to understand their process, legal requirements, paint points, and find areas of improvement. It was also my responsibility to find overlaps in problems with other markets.

Research methods used

I researched the problem in Sweden through

user interviews

reading existing manuals

video recordings

shadowing

I spoke to team managers in the other markets to understand overlaps in the problems the users and the system were facing.

Below are screenshots of my research where I researched user workflows, map existing system logic, and ideal workflows.

I cannot show you the notes/screenshot in detail as they include sensitive company data.

Initial research and gather data and pain points.

Initial research

Mapping a very basic system logic of different scenarios and edge cases.

Mapping system logic of different scenarios

Understanding how different databases and systems communicate.

Key Findings From My Research

The invoicing system presented critical challenges across all markets, with Sweden being disproportionately affected due to its high invoice volume.

Manual and Inefficient Invoicing Process

Every invoice was generated manually, requiring extensive time and effort.

On average, it took 23 clicks across 14 screens to create a single invoice under ideal conditions. This equated to about 3-5 minutes per invoice in ideal conditions depending on the user.

Basic errors or edge cases required even more steps, further increasing time and frustration.

System Performance Issues

The system was slow to load invoices, policies, and status updates, disrupting user workflows.

To compensate, users exported data to Excel sheets, creating fragmented workflows and multiple sources of truth.

Below is a pixelated image of the previous PIA table, shown this way to protect sensitive information. The screenshot illustrates how long these tables were, while providing little insight into the status of each line item.

Workload Bottlenecks and Overtime

The last 1.5 to 2 weeks of every month were dominated by invoice creation, leaving little time for other tasks.

Account managers worked overtime regularly, leading to:

High stress levels

Decreased morale

Neglected responsibilities outside of invoicing

Increased employee turnover

Delayed Invoicing and Customer Impact

The manual and time-consuming process often led to delays in invoicing, especially at month-end.

This affected customer and broker satisfaction, damaging trust and relationships.

Decentralized Communication

Invoices were sent from individual account manager email addresses, making tracking and accountability difficult.

External System Dependencies

Syncing insurance vehicle data with Transportstyrelsen (Swedish Motor Agency) was required. This syncing process existed but required 10 clicks across 7 screens to manual syncing per policy—further slowing down operations.

Lack of Documentation and Standardization

Brokers had different requirements for invoice attachments.

These preferences were not documented and instead relied on informal, experience-based knowledge.

User story

As an Account Manager,

I want an automated system to generate and deliver invoices,

and an admin interface to manage manual invoices when needed,

so that I can minimize time spent on manual tasks and focus on higher-value activities.

Primary Target Audience

Account Managers: responsible for invoice generation/sending, error handling, manual invoice administration.

Secondary Target Audience

Brokers: recipients of invoices and settlement notes.

Team managers: Those responsible for account managers and business goals.

Mapping logic based on user input and automation

I led collaborative sessions with developers, product managers, and end-users to map the core system logic, a crucial step given the complex and manual nature of the previous process. I used FigJam to visualize every step, from automated triggers to error handling, manual overrides, and user input. This mapping was essential for the team, as it served as a single source of truth for both the development of the back-end code and the design of the front-end UI/UX, ensuring the new system was both scalable and user-friendly.

Sensitive data redacted in image below.

Key Features - UX design contributions

As Senior UX Designer, I led the research and design of the new invoicing system. I collaborated closely with account managers, team managers, and developers to uncover pain points and create solutions that balanced automation with human oversight. Below are the features I personally designed and their impact.

Automated vehicle validation

Eliminated manual syncing with national transport data.

Each vehicle policy required validation via Transportstyrelsen (Swedish Motor Agency) to verify the roadworthiness of insured vehicles and vehicle data. I designed a system-level sync that automatically retrieved and verified this information overnight when system load on both Protector’s and Transportstyrelsen’s system would be low.

Why it mattered:

This single feature eliminated a repetitive, manual task that previously required about 1-2 minutes consisting of 8 clicks across 6 screens per policy, ensuring data accuracy, reduced operational load, cost, and improved compliance—all without adding friction to the user experience.

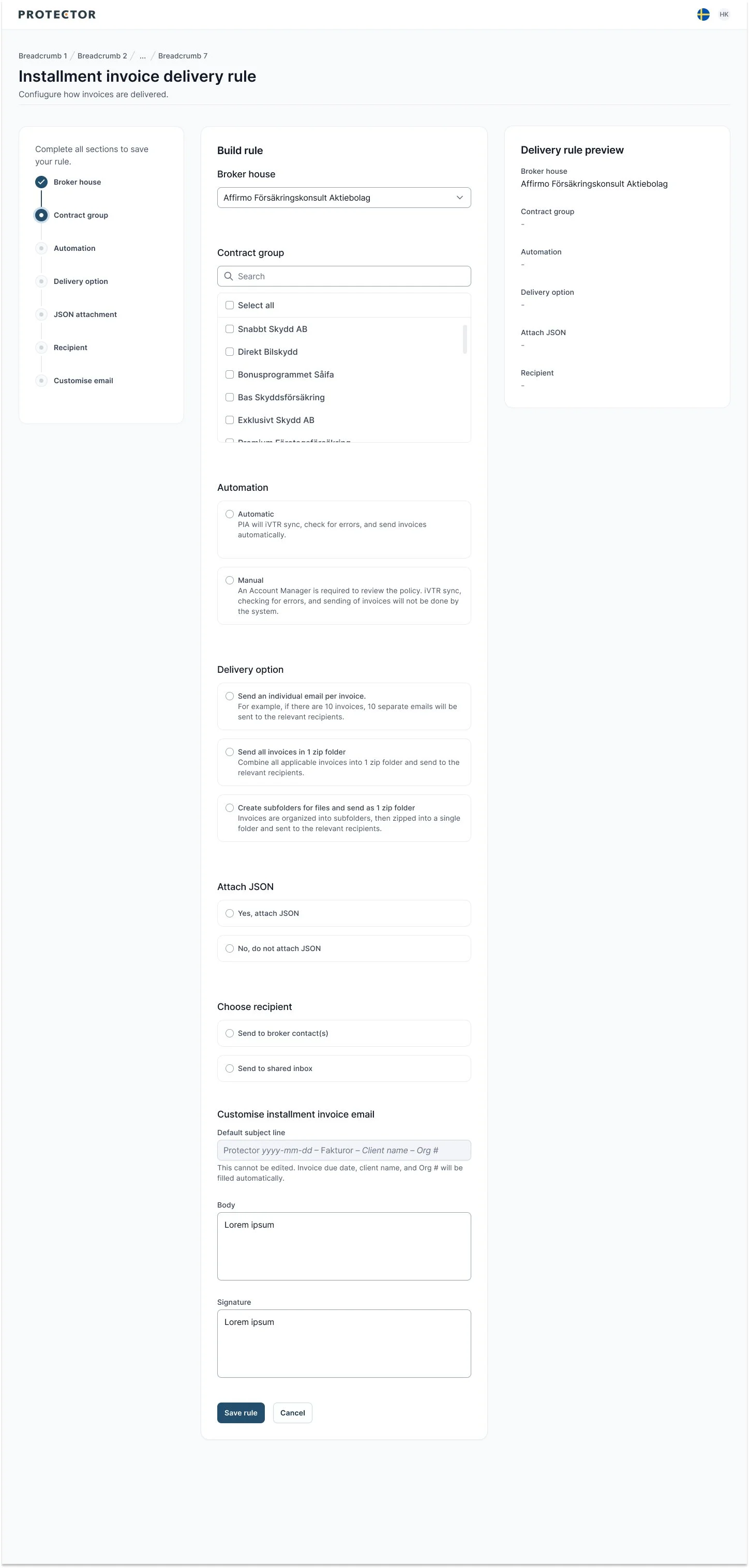

Customized Invoice Delivery Settings

Designed to support broker-specific preferences and reduce communication friction.

I created a flexible settings page that allowed account managers to define file attachment preferences for each broker. This configuration only needed to be set once or updated as needed, streamlining operations.

Why it mattered:

Brokers had strict preferences for how they received invoices, and aligning with those preferences helped strengthen relationships and reduce back-and-forth communication. By making this process configurable and reusable, we saved time and ensured consistency. In addition, this approach elimanated hardcoding (which was previously being done) making the system more scalable, adaptable to future changes, saving developer time.

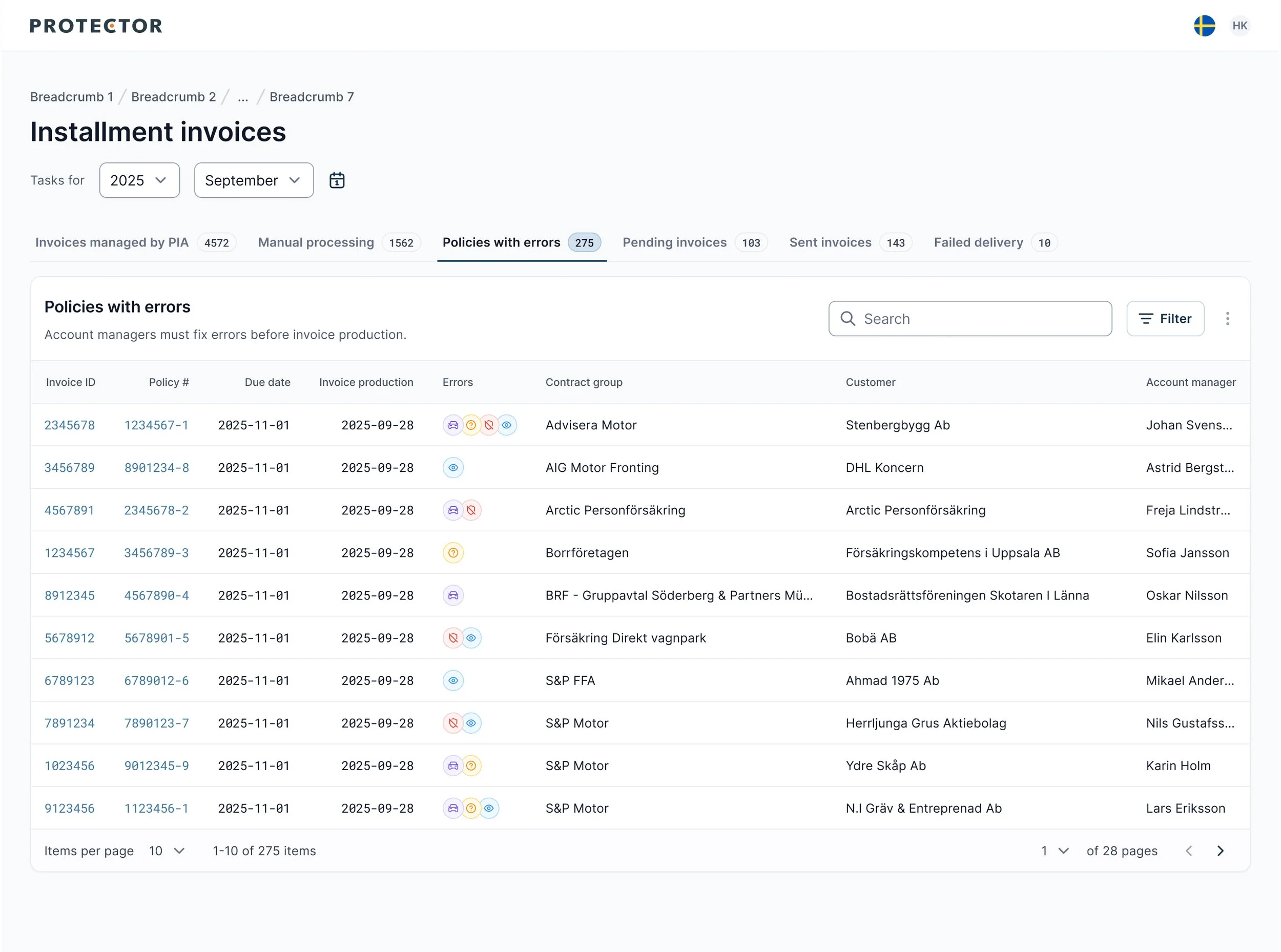

Transparent Invoice Status Tracking

Increased trust in automation by making the invisible visible.

I designed a page that visualized each invoice's stage in the automated pipeline: invoices managed by PIA, manual processing, policies with errors, pending invoices, sent invoices, failed delivery. Users could filter, sort, and inspect individual policies and invoices within these steps.

Why it mattered:

Introducing automation into a previously manual workflow required building user trust. Transparency into the process helped users feel in control, spot technical issues early, and reduce anxiety about the system "just working."

Bulk Manual Invoice Processing

Prevented customer confusion through smart batch operations.

I introduced and designed a feature that allowed account managers to send batches of invoices to a single broker directly through the system. This prevented brokers from receiving multiple fragmented emails and reinforced credibility by ensuring all invoices were sent from one centralized platform rather than individual email accounts.

Why it mattered:

In scenarios where automation was bypassed (due to exceptions), this design prevented redundant or confusing touch points for end customers, reducing complaints and improving satisfaction.

Centralized Email Communication for All Invoices

Increased Credibility & Efficiency

All invoice are now sent directly through the system. Instead of relying on fragmented personal emails, all communication is now streamlined and automated within one platform.

Why It Matters

By sending all invoices through a centralized, professional system, we reinforced credibility and consistency in broker communications. The feature also eliminated fragmented emails, ensuring brokers received clear, consolidated messages. For account managers, it saved roughly one minute per invoice and eliminated 6–10 clicks across three screens—delivering significant time savings at scale.

Smart Error Handling & Troubleshooting

Reduced cognitive load during issue resolution.

I designed an error management system that checked for errors over night and grouped them. The system highlighted the specific error for each and included a quick preview to assist account managers with finding a resolution. Users could quickly identify whether the problem was data-related or system-related.

Why it mattered:

Before this, error checking and resolution was time-consuming and unclear as users had to manually check each individual invoice for errors, regardless of it had errors or not. By providing structured visibility and actionable insights, I reduced error checking time from 3-5 minutes per invoice in ideal conditions to zero. Actionable insights also empowered account managers to fix issues more efficiently.

My Impact & Results

My research and design contributed to automating the invoicing system. I created measurable impact for both the business and its employees:

Operational Efficiency & Cost Savings

Saved 200+ hours every month by automating repetitive manual invoicing tasks.

Saving €400,000 (projected) in Sweden within the first three years.

Scaled invoicing capacity without needing proportional increases in headcount.

Streamlined broker communication by centralizing invoice delivery into one professional, trusted system.

Account Manager Experience

Reduced stress and overtime by eliminating repetitive manual tasks.

Increased morale and job satisfaction by giving employees more control and transparency into the invoicing process - they even threw a party in the Sweden office to celebrate the reduced workload.

Improved employee retention by reducing one of the most significant pain points for account managers.

Time and Work Savings

Reduced workload to zero for standard invoice processing—elimanted 23 clicks across 14 screens and cutting 3–5 minutes of manual work per invoice.

Removed 100% of manual vehicle validation by automating data sync with the Swedish Motor Agency—saving ~10 clicks and 1–2 minutes per policy.

Accelerated error resolution with a clear, guided dashboard that grouped issues and enabled quick fixes.

Boosted employee morale by reducing overtime and repetitive tasks, improving retention and job satisfaction. They even threw a party to celebrate the massive reduction in workload 🎉

Strengthened broker relationships by ensuring invoices were always timely, accurate, and formatted to their preferences.

Improved employee retention by reducing one of the most significant pain points for account managers.

Customer & Broker Relationships

100% on-time & reliably delivery of invoice to the correct brokers with their specific preferences applied.

Reduced confusion and complaints by centralized communication.

Strengthened trust through faster, consistent, and more professional communication.

Business Alignment

Supported Protector Forsikring’s strategic goals of operational efficiency, scalability, and stronger broker relationships.

Laid the foundation for expansion of automation across additional markets beyond Sweden.